How to Choose a Dental Insurance Plan

The difference between DHMO and PPO plans, and better alternatives to dental insurance.

Patients regularly ask me to advise them on what kind of dental insurance plan to buy. Unfortunately, if you are not already receiving dental benefits from your employer, any plan you purchase individually is almost guaranteed to be a poor value. (Learn more about how dental insurance differs from medical and other types of insurance here.)

Luckily, we have created an in-office membership plan that saves our uninsured patients much more money than purchasing dental insurance!

That being said, it is important to understand the different types of dental insurance plans in case you already have one or if you have the option to purchase one at a discount through an employer.

Types of Dental Insurance Plans

The two main types of dental insurance plans are DHMOs (Dental Health Maintenance Organization) and PPOs (Preferred Provider Organizations).

DHMO Plans

DHMO plans are typically much cheaper to purchase, and seemingly offer coverage for most common procedures. Some DHMO plans even offer deceptively high annual maximums, giving them the appearance of being a great value.

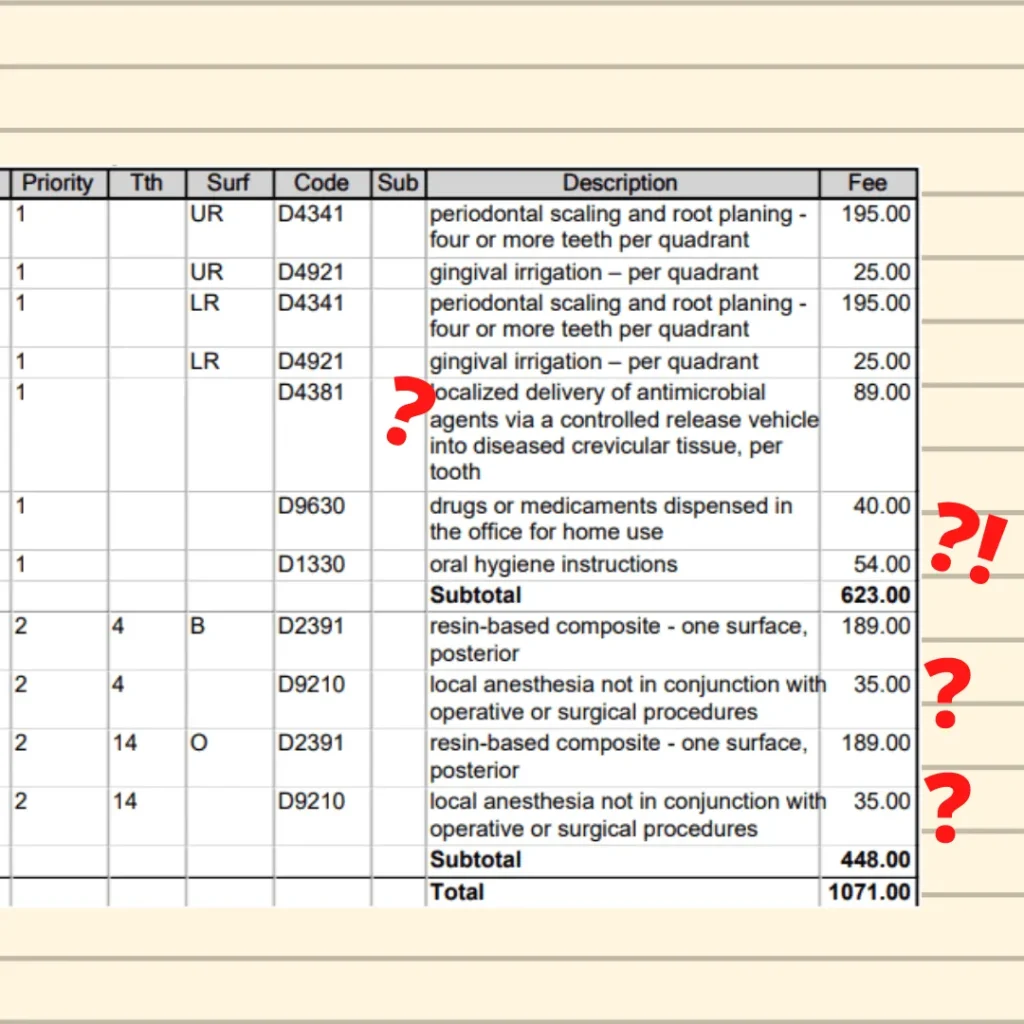

However, DHMO plans are the most restrictive type of dental insurance, which is one of the reasons it can be difficult to find a dentist who accepts your plan. In addition, DHMOs reimburse dentists at a notoriously low rate, often much, much less than the cost of providing the service! As a result, it is common to see many “extras” and “upgrades” on your bill, since some dentists resort to this tactic to make up for losses from DHMOs. In the interest of integrity and quality of care, and since DHMOs do not allow you to see the dentist of your choice, we do not accept any such plans.

PPO Plans

The second main type of plan is a PPO or Preferred Provider Organization. Many patients mistakenly believe that they must go to an in-network dentist (“Preferred Provider”), even with a PPO plan. In fact, most of our patients choose our office despite our being out-of-network with their plan, due to the care we take to treat each patient as an individual, from taking the time to thoroughly explain treatments and diagnoses, to ensuring the comfort and safety of our patients during and after their visits.

While we are out-of-network with most plans, we are happy to file your PPO insurance for you as a courtesy. We actually advise you on how to get the most out of your benefits! The best PPO plans provide comparable coverage regardless of whether you visit an in or out of network dentist, truly giving you freedom of choice. If your employer offers you the option to purchase such a plan at a discount, it may end up being a good value, since group plans have fewer waiting periods and other restrictions than individually purchased plans.

Unfortunately, some PPO plans provide a very low amount of coverage. This is typical of individually purchased plans. Even well known insurance companies with large networks are now offering cheap plans directly to patients. However, these plans can be very misleading, since they are often on a lower tier than the “regular” plans, and therefore offer far less coverage!

I see this as a “bait-and-switch” tactic, since I have encountered patients who have purchased these plans, thinking their dentist is in-network with their insurance company, without realizing that the same company operates multiple networks, some far worse than others, with almost no participating dentists in the area. Even worse is the fact that these plans often have a very long waiting period before they cover major dental services.

If this has been a confusing read, you’re not alone. I myself am blown away each time I discover a new way that dental insurance companies mislead and swindle patients, whether by selling them useless plans, or denying coverage based on complicated rules and restrictions.

Alternatives to Dental Insurance

For the reasons outlined above, I do not recommend buying dental insurance unless your employer offers you a PPO plan at a discount. Even then, keep in mind that you may still have out-of-pocket expenses when going to the dentist, as most dental insurance is more of a benefit coupon than true insurance.

I have never been comfortable with the tactics dental insurance companies use to deny coverage, or the “games” participating dentists are forced to play in order to abide by network contracts. It has not been easy, but I am proud to put transparency and fairness first by avoiding unfair discounts dictated by insurance networks. This has allowed Wave Dental to pass much greater savings directly to patients with our in-office membership plan! Click here to find out how our plan is a better deal than insurance.

As always, thank you for reading and feel free to email me with any questions.

0 Comments